Bitcoin mining is a foundational component of the network and Bitcoin as an asset. Despite its importance, mining has been among the least transparent and the least understood part of the broader Bitcoin ecosystem. This report by BitOoda serves to improve the transparency related to the composition of Bitcoin miners, which ultimately helps with understanding the state and health of the system. At Fidelity Center for Applied Technology (FCAT), we look forward to continuing our research of the Bitcoin mining space and helping to push the ecosystem forward. We thank the BitOoda team for their work, which we hope will elevate everyone’s understanding about this complex and fascinating part of the Bitcoin ecosystem.

– Juri Bulovic, Fidelity Center for Applied Technology

Bitcoin mining is a secretive industry, with very little publicly available information. We find that even the more sophisticated crypto investors have gaps in their understanding of mining and the potential investment opportunities in the space. Despite stellar research by Coinmetrics, Coinshares, and the Cambridge Center for Alternative Finance, unanswered questions remain. This research has been commissioned by Fidelity Center for Applied Technology (FCAT) to add to the existing body of research, build upon prior research and attempt to address new questions. Click here for the full report

Section I: Bitcoin Power Capacity Analysis: How much, where, and at what price

In this first section, we attempt to measure, locate and price miners’ power capacity and estimate miner profitability. With more than 60 conversations with miners, rig manufacturers and resellers, as well as more than 45 public data sources, we worked to provide as complete a picture as possible of how much Bitcoin mining capacity there is, where it is located, and what miners pay for power.

We then further explore the question of how mining capacity could grow in the future as a function of available electricity, the efficiency of mining rigs, and the constraints that the price of Bitcoin, capital / funding availability, and semiconductor technology and capacity might place on Bitcoin mining capacity.

We assess that the Bitcoin Mining industry has access to at least 9.6GW of power

Our 9.6GW estimate uses the following logic: on May 10, just before the Bitcoin reward halving, Hashrate peaked at 136,098 PH/s and dropped to 81,659PH/s at the trough on May 17th. We acknowledge that some portion of those extremes may be attributable to luck — such as a lucky streak or finding blocks quickly — that could artificially inflate the estimated Hashrate, while a streak of slower blocks could be partially due to bad luck. Nevertheless, we exclude luck from our model and make simplifying assumptions to arrive at an approximation of how much power the Bitcoin network consumes. We assume that all the Hashrate that remained on the May 17 trough was from the more profitable, newer generation of mining rigs — the “S17 class” of rigs that include Bitmain’s Antminer S17s, T17s, Whatsminer M20s, and devices from Canaan, Innosilicon, Ebang and others. We also assume that all the devices switched off between May 10 and May 17 were older generation, less profitable rigs of the S9 class (such as Antminer S9, Whatsminer M3).

Note that we use “S17 class”, “S9 class” and “S19 class” as generic terms to include Bitmain devices as well as competing devices with similar specifications. We only use Bitmain model numbers to define the class because of Bitmain’s history as the dominant player in the “S9 class” and to a lesser extent, in the “S17 class” of devices. We also assume a PUE (Power Usage Effectiveness) of 1.12 across all relevant calculations, which means that for every 1MW used to directly mine Bitcoin, another 120kw is used to run everything else, including cooling systems, lighting, servers, switches, etc.

Figure: BitOoda classification of rigs into key rig classes

Source: BitOoda, Bitmain, Canaan, MicroBT, Halong, GMO, AsicMinerValue.com

The figure below shows that if all the Hashrate in operation on May 17 was newer S17 class equipment, they would consume 3.9GW of power. Further, if all the 54EH/s of Hashrate that was shut off between May 10 and May 17 was older generation S9 rigs, that would account for an additional 5.7GW of power. We make these simplifying assumptions to help arrive at a broad understanding of the space, knowing that the likely reality is that most but not all of the shut-off capacity was older S9 class rigs, and some small share of the remaining capacity at the trough was probably S9 rigs in very low-cost power markets. The reduced profitability of equipment post-halving was the key driver of capacity reduction, combined with some timing related to shifting rigs from northern to southern China to take advantage of lower power costs (see Section II for more details on the impact of China’s hydro season). Based on these assumptions, we estimate that there is at least 9.6GW of power available to the Bitcoin mining community.

Figure: Bitcoin Hashrate and power consumption at recent peak and trough

Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics

We assess that the BTC mining industry utilizes ~67% of 9.6GW available power capacity, growing at ~10% per annum, powering 2.8mm dedicated Bitcoin mining rigs. Most current devices are S17 class, but future growth will largely come from next-gen S19 class mining rigs. Some of the Hashrate that came back online from the May 17 trough is probably from S9 class rigs that either operate in extremely low-cost jurisdictions, or had a delayed transfer (to avoid downtime in the days leading up to the May 11 reward halving) from higher cost regions in northern China to take advantage of low-cost power in Sichuan and Yunnan during China’s annual flood or hydro season.

Additionally, despite supply chain delays, limited shipments of next-gen Antminer S19s and Whatsminer M30s have begun, along with some S17 class shipments, accounting for a portion of the Hashrate recovery.

Figure: Bitcoin Hashrate, power consumption and installed base of rigs — Data as of 7/1/2020

Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics

Estimated mining capacity is roughly 50% in China, with the US accounting for another 14%

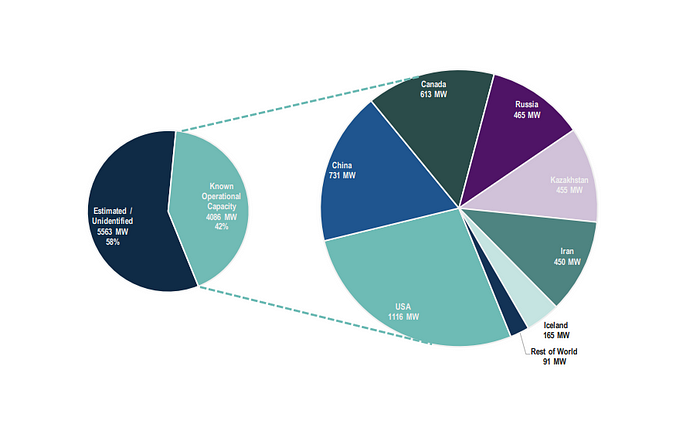

We used a variety of public sources, as well as confidential conversations with miners, rig manufacturers and dealers, to assess where Bitcoin mining capacity is located and how much miners pay for power. We were able to locate ~4.1GW of power across 153 mining sites, including 67 sites or ~3GW power capacity, with power price data provided upon condition of anonymity.

Figure: Geographic distribution of surveyed mining capacity vs estimated 9.6GW total capacity

Source: BitOoda estimates, Miners, ASIC makers / resellers, public sources

Our conversations lead us to believe that we have accounted for the majority of capacity in the US, Canada and Iceland, but only a small fraction in China and the “Rest of World” category. During discussions with miners, we asked them not only about their own capacity, but how many other miners they were aware of in their market, and how much total capacity they thought was in the region. We know these are approximations, but we nonetheless find this a useful approach to arrive at estimates of the overall geographic distribution of mining capacity

Figure: Geographic distribution of surveyed mining capacity vs. Estimated 9.6GW total capacity

Source: BitOoda estimates, Miners, ASIC makers / resellers, public sources

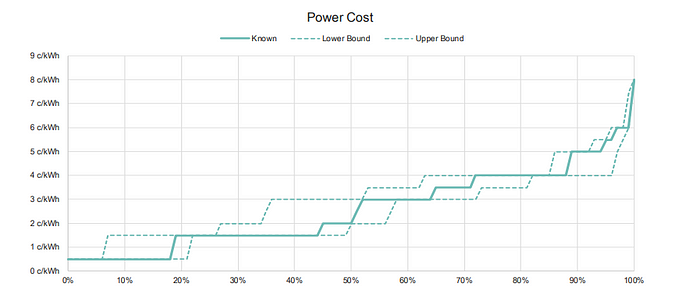

In our assessment, 50% of Bitcoin mining capacity pays 3c or less per kWh, a steady decline over the past several years. Anecdotal evidence suggests this number was closer to 6c / kWh in 2018. As revenue per PH/s has decreased with increase in network Hashrate, miners with high power costs have either shifted to lower power cost regions or shut down.

Figure: Power cost curve: Mapping power cost vs. Share of network capacity

Source: BitOoda estimates, Miners, ASIC makers / resellers, public sources

Our cost curve estimates translate to a median cash cost to mine 1 BTC of about $5000, with an upper confidence bound of about $6000. This estimate is cash operating expense and does not include depreciation or other costs for mining hardware.

The curve also reveals that a small percentage of Bitcoin is mined at cash costs above the current spot price of Bitcoin. We believe some of this non-economical mining is dictated by power purchase commitments, and potential incentive payments to shut down capacity at peak demand times and to acquire Bitcoin in jurisdictions with limited or more expensive trading options.

Figure: Cost to mine 1 BTC, based on network capacity at different power costs — Data as of 7/1/2020

Source: BitOoda estimates, Miners, ASIC makers / resellers, public sources

We note that S9 class rigs need sub-2c/kWh to break even at the current network Hashrate, and will likely need even lower power prices to remain viable as Hashrate continues to increase. Our cost model assumes that it takes one person to run about 5MW of capacity. Since S9 class devices are less power efficient than newer rigs and need more devices per PH/s of Hashrate, they consume more power than newer devices and need more labor and overhead cost for the same Hashrate. It takes 30kW and just over 9 devices to generate 1PH/s of Hashrate with S19 class rigs. If mining with S9 class rigs, it would take about 70 devices and over 100kW, and correspondingly more maintenance and operations labor cost and power overhead to generate the same 1PH/s of Hashrate.

Figure: Daily revenue and cash operating costs for different rigs at different power price, at current Hashrate

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

Labor Cost is based on maintenance and operating staff needed to run a scale facility (>50MW), per our miner conversations

In summary: we estimate that there is about 9.6GW of available power capacity for mining Bitcoin, with a current utilization in the mid 60% range. This capacity has a median power price of ~3c/kWh and a median $5000 cash cost to mine 1 BTC. We estimate China accounts for about 50% of global capacity, while the US follows with about 14%. A significant portion of Chinese capacity migrates to take advantage of lower power prices during the flood season, examined in detail in Section II.

Section II: Some surprising conclusions on the relationship between Hashrate growth and China’s flood season

We have found that China contributes 50% of the Bitcoin mining power consumption and network Hashrate. Here, we take a deeper look into the Chinese bitcoin community and the effects of China’s hydro season on the bitcoin price and network Hashrate.

So what is Hydro season? The Southwestern provinces of Sichuan and Yunnan face heavy rainfall from May to October. This leads to huge inflows to the dams in these provinces, causing a surge in production of hydroelectric power during this time. This power is sold cheaply to Bitcoin miners, as the production capacity exceeds demand. Excess water is released from overflowing dams, so selling cheap power is a win-win for both utilities and miners. This access of cheaper electricity prices attracts miners who migrate from nearby provinces to take advantage of the low price. Miners pay roughly 2.5–3c / kWh in northern China during the dry months, but sub-1c / kWh in Sichuan and Yunnan during the May-October wet season.

We argue against conventional wisdom, which suggests that low power prices drive Hashrate growth during the flood season. In our view, the flood or hydro season shifts the cost curve down for 6 months of the year, leading to lower sales of Bitcoin to fund operating expenses as miners accumulate capital to fund capacity growth.

As shown in the chart below, there is a meaningful difference between the average price gains during flood and dry seasons, while Hashrate growth is about the same during both periods. We have shown growth in each individual period, recognizing that the first two periods were likely outliers (further supporting our thesis), and the averages are based on a small sample size of the subsequent 11 alternating 6-month periods.

Figure: Hashrate and BTC price, segregated by flood and dry seasons

Notes: Since 2014; averages exclude Nov 2013-October 2014; data as of 7/1/2020

Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics

This dynamic of capital accumulation followed by equipment purchase, delivery and deployment is reflected more broadly in the correlation between price appreciation (which supports capital accumulation) and Hashrate growth 4–6 months later, as the supply chain delivers the equipment purchased.

China’s hydro season can result in a lowering of the cost curve, which can aid capital accumulation and help contribute to the growth of future Hashrate. An increase in capital accumulation would reduce the industry’s demand for external funding to support the future growth of Hashrate.

Figure: Correlation between price changes and Hashrate changes

Note: Past 12 months, data as of 7/1/2020

Source: BitOoda, Blockchain.com, Kaiko, Coinmetrics

We look at the correlation in the price changes over a duration of 15-to-360 days with hash rate changes over the same period for the past year. We notice that hash rate follows price with a lag of 4–6 months, with a high correlation. This establishes a dynamic of capital accumulation followed by equipment purchase, delivery and deployment as the supply chain delivers the purchased equipment.

The available and underutilized power capacity, capital accumulation from internal generation by the industry (aided by China’s hydro season), and external funding, as well as diminishing revenue per PH/s, all play a role in the future growth of Hashrate. We examine the future of hash in Section III.

Section III: Bitcoin Hashrate Growth Projections: How much, by when, why, and what could slow (or accelerate) growth.

We dive deeper into how much the network Hashrate can grow, what factors support this growth, and the capital and funding constraints that might mitigate this projected growth.

By our assessment, the Bitcoin network can exceed 260EH/s in Hashrate in the next 12–14 months, led by a modest increase in available power capacity from 9.6 to 10.6GW and an upgrade cycle that will replace older generation S9 class rigs with newer S17 and next-generation S19 class rigs. The growth in power capacity is based on available power at mining locations, planned infrastructure spending and the view that some higher cost mining locations may need to shutter operations because of revenue pressure.

Figure: Bitcoin Hashrate and power consumption

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Data as of 7/1/2020

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

The completion of the upgrade cycle to S19 class rigs by mid-2022 will likely take network Hashrate to ~360EH/s. We assess that the next radical device upgrade might not take place until mid-late 2022, although incremental power efficiency improvements are expected in the interim. We note that if Bitcoin price stayed flat or fell, USD revenue per PH/s would continue to fall to the point of marginal cost, and further investment and Hashrate growth might be slowed meaningfully — so our Hashrate projections may face delays or may never be achieved.

We looked at where TSMC’s progress, compared with Samsung and Intel — although Intel does not make mining ASICs, the available data demonstrates the wide differences between process technologies by different semiconductor suppliers. We note that the next major step in ASIC technology will come with the ramp up in 5nm technology. At this node, TSMC, the primary supplier to Bitmain, has a lead over Samsung. However, while TSMC is seeing volume orders at both 7nm and 5nm nodes, their process geometries look similar to Intel’s 10nm node; we believe Samsung also features a tighter process geometry; thus, Samsung is close behind TSMC. ASIC’s are primarily logic chips, so a comparison to Intel makes sense. As the semi industry has evolved, we note an ever-increasing divergence in feature geometry — thus, there are important differences between chip density, feature size and ultimately power consumption and thermal properties among different chip manufacturers, even at the same nominal process node.

Figure: Comparison of Intel and TSMC process geometry

Source: https://www.eetimes.com/intels-10nm-node-past-present-and-future/

Samsung recently announced that plans for commercial production on a 3nm process node would likely be delayed into 2022, while 5nm will likely be the mainstay of 2021 production (see this news article). We believe the dearth of 3nm capacity and likely initial low yields will lead to 5nm processes being the mainstay of ASIC development and production through 2022. For these reasons, we believe that S19 class rigs will form the bulk of shipments in the next 24 months, although incremental design improvements could lead to efficiency gains that could be reflected in new model lineups.

Figure: Hashrate (bottom) growth slows once power capacity is utilized and upgrade cycle is complete

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Data as of 7/1/2020

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

As the charts above show, even relatively modest assumptions of network power capacity growth and the broad deployment of S19 class rigs get us to 360EH/s of network Hashrate. Improved power efficiency (fewer Watts per TH/s) could pose an upside to these forecasts, but a critical issue is the diminishing Bitcoin earned per PH/s or per MWh — the total Bitcoin flow is roughly constant per day, fluctuating only with additional blocks and transaction fees. So if network Hashrate increases, a miner’s share of the total Hashrate and thus of Bitcoin flow falls. If the price of Bitcoin does not rise to keep up with increasing Hashrate, profitability will fall and a new equilibrium could be established at a Hashrate that is meaningfully lower than our projections here.

The chart below shows the Bitcoin earned per MWh for each device class: an S19 can earn almost 3x the BTC per MWh compared to an S9 class device.

Figure: Bitcoin earned per MWh as a function of network Hashrate

Data as of 7/4/2020; power consumption numbers include PUE of 1.12

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

The below chart shows how BTC per PH/s has changed (and is expected to change in the future) as a function of both network Hashrate and time, and factoring in pre-halving and post-halving block rewards. Here, too, one can see declining revenue in BTC terms. Viewing it on a device-independent basis per PH/s, it is clear that over time, price is a key element of sustained Hashrate growth.

Figure: Daily Bitcoin earned per PH/s over time and as a function of network Hashrate

Data as of 7/1/2020; historical data since 1/1/2018

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

The dollar value of mined BTC will fall over time, resulting in declining profitability unless the price of Bitcoin increases sufficiently to offset this. As the chart below shows, the revenue earned per PH/s per day is a function of both the Network Hashrate and the price of Bitcoin. At the current target network Hashrate of ~124EH/s and current BTC price of $9220, daily revenue per PH/s is ~$70. If network Hashrate were to increase to 260EH/s, as we expect over the summer of 2021, the price of Bitcoin would need to be ~$19,500 to have the same $70 in daily revenue per PH/s. At $10,000 BTC price, revenue per PH/s would be just $36. The middle chart below shows that it costs ~$37 in cash expenses to run 1PH/s per day on the efficient S19 class rigs at a 4c/kWh power cost, but running S9 class rigs at 4c/kWh power would cost $133. S9 rigs would need to operate at under 0.5c / kWh to break even at a BTC price of $10,000.

Figure: Daily revenue and cash operating costs for each rig class at different power price, at several FUTURE Hashrates and BTC prices.

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

The significant capital expense required to achieve the potential Hashrate is a limiting factor — in particular, if BTC price does not rise to keep pace with Hashrate, it will at a minimum inhibit internal cash generation for the industry, further increasing reliance on external sources of capital. Furthermore, it could pose a downside to our Hashrate projections by driving higher-cost miners out of operation and limiting external capital flows as proposed projects face uncertainty and falling Return on Investment expectations.

What if price stayed flat? At what point would Hashrate no longer grow? If the price of power was 1c/kWh, S9 rigs could keep operating up to 180EH/s network Hashrate. At 3c/kWh, S19 class devices can sustain operations up to 295EH/s. Beyond that point, S19s would need higher BTC prices or lower power prices to remain in operation. However, the devices would fail to recover their cost of capital at Hashrates well below 295EH/s. Clearly, price appreciation is built into every miner’s capital budget.

Figure: Daily revenue and cash operating costs per PH/s as a function of network Hashrate

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

Total Capex required to achieve 260EH/s in the next 12 months is $4.5 billion, with an additional ~$2 billion to get to 360 EH/s by mid-2022.

Figure: Bitcoin Hashrate and power consumption

Note: We assume a PUE of 1.12 to estimate share of power actively used to mine Bitcoin

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

If Bitcoin price were to appreciate steadily to ~$19k in two years at a 40%+ annual rate, S19 class rigs will remain viable even at 5c/kWh power cost, but will leave a funding gap of ~$4.1 billion between the industry’s total capex needs and the internally generated cashflow of the network.

Figure: Bitcoin network capex and internal generation

Data as of 7/1/2020; log scale on Y-axis

Source: BitOoda estimates, Blockchain.com, Kaiko, Coinmetrics

We have seen concerns that our Hashrate growth model requires significant deliveries of new rigs, and we have received questions about whether our forecast is feasible. Roughly 60,000 units need to ship weekly to grow the installed base of mining rigs in line with our Hashrate projections. By contrast, Bitmain was able to deliver over 95,000 units of S9 rigs per week during 1H2018, according to company filings. Despite uncertainty about the number of chips / die sizes inside S19 class rigs, we feel confident that semiconductor / assembly capacity will not be a limiting factor.

In conclusion, we believe that the Bitcoin Network Hashrate could reach 260EH/s in 12 months and 360 EH/s in 24 months. However, this is somewhat reliant upon the price of Bitcoin appreciating or being expected to appreciate at 25–35% annualized, as per our model. We do not model or forecast the future price of Bitcoin, but merely reflect the impact of potential price scenarios on Hashrate growth, power consumption and mining industry capital investment and profitability. Variance from this range could delay or accelerate Hashrate growth. Bitcoin price and the availability of external capital to bridge the funding gap are potential constraints to the industry’s ability to ramp up Bitcoin mining capacity to 360 EH/s, but the capacity to produce or assemble the needed semiconductor chips is not.

Investors need to take these projections into account while evaluating mining projects, and need to have a view on the price of Bitcoin. At BitOoda, we are strong proponents of hedging, and recommend investors pursue an active hedging strategy to mitigate operational risk — as we like to say, miners know what their expenses are going to be 6, 12, and 24 months out, but they don’t know how much Bitcoin they will receive or how much that Bitcoin will be worth. Hedging strategies can help lower operational risk and stabilize cash flows. Please reach out to us at info@bitooda.io to see our full report for the methodology, sources, and further details on the information presented here, or to discuss risk management strategies and trading opportunities on which we can collaborate with you.

About BitOoda:

BitOoda is a fintech and financial services firm specializing in digital assets. We have been pioneers in building the derivatives market for BTC and ETH, and have helped firms develop, manage, and execute risk management strategies through structured derivative and proprietary investment products.

What We Do:

1. Financial Engineering: We blend applied science with digital finance to develop and distribute a suite of next-generation digital asset and data analytics products.

2. Research & Advisory: We combine quantitative analytics and deep qualitative expertise to develop data-driven models, research products, and advisory strategies for our clients.

3. Agency Brokerage: We provide high-touch brokerage services and help clients navigate over-the-counter trades for digital assets, as well as block trades for Bitcoin futures contracts listed on Bakkt and CME.

4. Risk Management: We deliver bespoke risk management strategies and innovative structured derivative products to help our clients manage their positions and hedge risk.

For more information on BitOoda, please visit our website or contact us at info@bitooda.com

About the author:

Sam Doctor, the principal author of this report, is Chief Strategist at BitOoda. Sam Doctor’s flagship research includes both project evaluations and Bitcoin mining analyses focused on profitability and risk factors. Mr. Doctor has over 18 years equity, strategy and cryptocurrency research experience, formerly at JPMorgan in New York and Asia, and more recently as the Head of Data Science and Quant Research at Fundstrat Global Advisors.

Mr. Doctor holds a Finance & Strategy MBA from the prestigious Indian Institute of Management, Ahmedabad and is an Electronics and Semiconductor engineer from the University of Mumbai, India. He holds his Series 7, 63, 86 and 87 licenses with FINRA. More information on his LinkedIn page.